Introduction

Picture a universe where money remains stagnant, incapable of growing or working in your favor. That’s precisely why the ICSE Class 10 maths banking chapter holds immense significance. It serves as your gateway to understanding the financial dynamics that shape our contemporary society. Within this chapter, you transform into a financial investigator, delving into the realm of interest rates, loans, and investments. Banking encompasses more than mere money management; it involves transforming your money into a dynamic force. These mathematical concepts explored in the ICSE Class 10 banking chapter are not solely for examinations; they are life skills that empower you to flourish in the real world.

What is Banking?

In ICSE class 10 maths, the term “banking” usually refers to compound interest. Compound interest is an important concept in finance and banking. It involves earning interest not only on the initial amount of money deposited or borrowed, but also on any interest that has already been earned or charged. This leads to the principal amount growing exponentially over time.

Class 10 Banking Important Questions and Answers

Q1. Mr. Raj gets ₹ 7,688 at the end of one year at the rate of 12% per annum in a recurring deposit account. Find the monthly installment.

Options

(a) ₹ 500

(b) ₹ 600

(c) ₹ 700

(d) ₹ 800

Ans. (b) ₹ 600

Explanation:

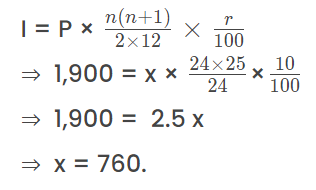

Q2. A bank offered a scheme of investing ₹ x per month for 2 years. If the rate of interest offered by the bank is 10% p.a. and the total interest received will be ₹ 1,900, then the value of x is

Options

(a) ₹ 700

(b) ₹ 750

(c) ₹ 760

(d) ₹ 800

Ans. (c) ₹ 760

Explanation:

we have

P = ₹ x, n=2 years = 24 months, r = 10% and

I = ₹ 1,900

We know,

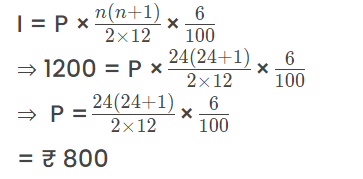

Q3. Mohan has a recurring deposit account in a bank for 2 years at 6% p.a. simple interest. If he gets ₹ 1200 as interest at the time of maturity, find :

(a) the monthly installment

(b) the amount of maturity.

Explanation:

(a) Since, number of months (n) = 24 and rate of interest (r) = 6%

∴ Monthly instalment = ₹ 800 Ans.

(b) Sum deposited = ₹ 800 × 24

= ₹ 19200

Amount on maturity = ₹ 19,200 + ₹ 1,200

= ₹ 20,400 Ans.

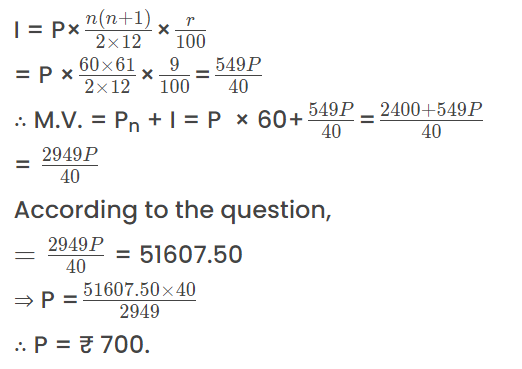

Q4. Anu has a cumulative deposit account in a bank for 5 years at 9% p.a. At the time of maturity, she gets ₹ 51607.50. Find the monthly installment.

Explanation:

we have, n = 5 year = 5 × 12 = 60 months, r = 9% M.V. = ₹ 51607.50.

Since,

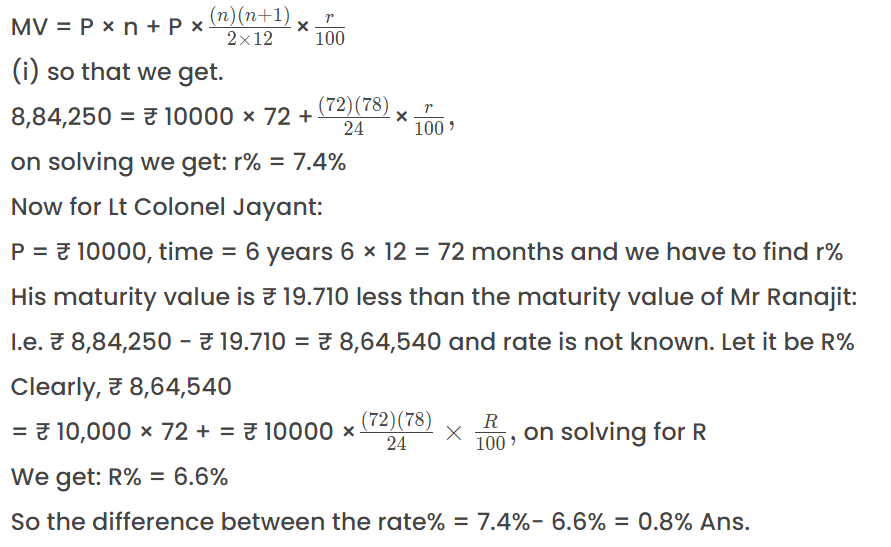

Q5. Government-owned banks have security assured over the investments made by the customers, while private banks provide better services and rate of interest to attract customers. A retired manager from Punjab National Bank, Mr Ranajit Bhattacharya invests in a recurring deposit scheme in IDBI bank with ₹ 10000/-for 6 years and receives ₹ 8,84,250/-. His friend Lt. Colonel Jayant Paranjpe invested in a similar recurring deposit scheme with Punjab National Bank with ₹ 10000/-for 6 years and receives ₹ 19,710/- less than Mr Ranajit Bhattacharya. What is the difference between the respective rates of interest of the two banks?

Explanation:

Here we have Ranajit Bhattacharya.

P = ₹ 10000, time = 6 years 6 × 12 = 72 months and we have to find r%

Clearly,